Bid-Ask Spread: Understanding the Bid/Ask Price

Download (Login required) Audio PDF

When buying or selling a stock, why are there two prices displayed at the same time? One price is called the Bid Price, and the other price is called the Ask Price, also often called the Offer Price. The Ask Price is what you will pay to buy a stock, and the Bid Price is what you will receive if you sell a stock. Another important aspect is the Bid/Ask Spread, which is the difference between the Bid/Ask Prices. It is vital to understand the Bid/Ask Spread characteristics before buying or selling a stock.

Clarification

If you are looking up stock market terms, it can seem as though the definition given here is the opposite of the standard definition provided. It is merely a matter of perspective. Most definitions use the perspective of a market maker or from whom you are buying or selling. For this article, the perspective is from your point of view as an investor.

Another point to make in this discussion is I will only focus on stocks. All financial markets have Bid/Ask Prices that fluctuate while that market is open except for mutual funds. Mutual funds have one price each day called a NAV, which is calculated shortly after the market closes.

If this is new to you, remembering what each term means can be confusing. Perhaps you can try using “word association” to help you: Bid = Sell, or “BS.” Yes, it might be crude, but it has always worked for me! Then, I can deduce that the Ask Price means to buy. Whichever way you find easiest, it is essential to know the difference and use them to make decisions.

The Bid/Ask Spread

In an ideal world, there would be a “one-price-fits-all” scenario. But this is not how things work. There are people on the other side of each transaction, usually market makers, who make money by having these prices different. The bigger the spread, the more money they can potentially make.

The Bid/Ask Spread is often overlooked or not considered by investors when buying or selling a stock. Some stocks have a narrow Bid/Ask Spread, while other stocks have a wide Bid/Ask Spread.

Why is this important? If one stock has a Bid/Ask Spread of $0.10 while another stock has a Bid/Ask Spread of $0.08, that means there is a difference of $0.02 per share between them. Two cents may not seem like much, but when buying or selling hundreds, thousands, or even millions of shares at a time, the difference can add up quickly.

Bid/Ask Spread Difference = $0.02

100 shares = $2

1,000 shares = $20

10,000 shares = $200

When combined with other expenses, such as commissions and the number of transactions, this can significantly eat away at overall returns or add to losses.

Volume

The width of the spread is usually determined by one major factor: Volume. Generally, the greater the volume, the smaller the spread. The lower the volume, the wider the spread.

Each stock is different and should be analyzed independently. Volume is defined as the number of shares bought or sold during a given time, usually daily. We want the Bid Price to be as close as possible to the Ask Price. Stated another way, we want there to be a small Bid/Ask Spread.

Stocks that are not traded very heavily often have large or wide Bid/Ask Spreads. Sometimes the Bid/Ask Prices can be very different from each other. Liquidity, the ability to buy or sell quickly, plays an important role for all investors. After deciding to buy or sell, it can be frustrating to mark time for minutes, or hours, waiting for an order to be filled. With wide spreads, it is common for orders never to be filled at all! To overcome this frustration, investors often let emotions take over, which opens the door for mistakes. Instead of waiting for a specific price to be filled, an investor may decide to place a market order, which helps ensure execution, but may result in a poor fill price. When selling, an investor may choose to get out at any price, especially if the market is near the close or crashing. This is not a good practice.

Another Liquidity Problem

Thinly traded stocks can produce the illusion of a significant price movement when the stock did not move in reality. What did happen was a trade was executed at either the Bid Price or Ask Price, which was different from the last traded price. Since the spread is wide, this can look like a big move. For example, a stock has a last traded price of $10 per share. The Ask Price is 10.25, and the Bid Price is 10. A sudden shot to $10.25 can get investors excited, thinking there was a $0.25 move. When what happened was a trade simply occurred at the Ask Price. This can produce further confusion and frustration if the next trade occurs at the Bid Price. What looks like big moves were merely trades being filled at the current Bid/Ask Prices.

Confusion

Understanding the Bid/Ask Price can get a bit confusing when watching a ticker running across the bottom of a TV or computer screen. If you see just one price, how do you know what just happened? Was that a buy or a sell? For many years, it was hard to tell since all transactions were displayed using the same color (white). Now, it is common to see prices as either red or green (kind of like the TV show). This does not mean the stock is up or down from the previous day’s close. If the color is green, the trade was executed at the Ask Price. If the number you see is red, the trade was executed at the Bid Price. That makes it a bit easier but can still be a daunting task. However, if you see a lot of red or green in a row, this can help determine whether more buying or selling is occurring. Methods such as “following the ticker” or “reading the tape” are common skills developed by many successful investors. For most “regular people,” watching the ticker all day is not possible, practical, or even enticing. Thankfully, tools have been added to software and websites that can give quicker insight. Some services analyze each trade by looking at the size and price as well as displaying what has already happened and what is still waiting to happen.

Confusion can also occur when only looking at the current price. You run to check your stock price and only see the last traded price. There isn’t any context to base price action, volume, or the Bid/Ask Spread. Implementing the tools in this article can help you understand what is going on and lead to less confusion.

Bid/Ask Spread Comparisons

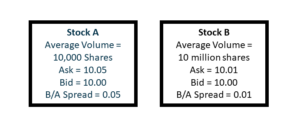

Let’s say you want to invest in a stock, and you have narrowed it down to two stocks, but you only can invest in one. We will call them Stock A and Stock B (I know, not very inventive names). Both stocks are currently trading at $10 per share. Which one do you pick?

You look up each stock and notice that Stock A traded 10,000 shares and Stock B traded 10 million shares yesterday. Is that a lot, or is that not very much? Is knowing this even necessary? Comparisons and generalized rules can be applied to make this information more helpful.

Volume Comparisons

One way to compare is to look at the volume for other stocks. These are quickly found online and often mentioned in the financial media. These are typically the stocks that are making news for one reason or another. News outlets just love to talk about this stuff since it gives them something to do.

You make a quick comparison and see that stocks with the highest volume traded 50-100 million shares yesterday. How does that compare with Stock A and B? Simple logic tells you that Stock A (10,000 shares) probably has a wide Bid/Ask Spread since it is a thinly traded stock compared to other stocks. Stock B (10 million shares), although not a volume gangbuster, is much better. Ten million daily shares is relatively healthy volume and will likely have a smaller Bid/Ask Spread. In this comparison, Stock B is the better choice. However, there is still another problem.

Any stock can be in the limelight at any given time. News, fads, and fixations can influence the volume of a stock for one day or possibly even many days. What is missing is the proper context. You want to know what the likely volume is going to be each day. To understand that, an even better method can be implemented.

What you need is the average daily volume. I use many average calculations to analyze the markets, but I have found a 90-day average to be a good measurement for volume. This allows for much of the “noise” to be taken out of the daily results, which allows for a more consistent view of likely daily volume. Investors may vary in the best average for them since this can be tailored to different investment styles, approaches, and goals. Some may prefer 20 to 30-day averages since that is closer to the number of monthly trading days. Others may prefer 200-250-day averages since that is closer to the number of trading days each year. There is no right or best answer. Each investor will need to reach this conclusion independently and decide what works best for them.

Even when trading shorter time frames, such as days, weeks, or months, it is still best to focus on stocks with greater longer-term average daily volume because of the potential Bid/Ask Spread advantage.

Generalized Rules

Now that you have some comparison guidelines, you can develop some rules.

- Focus on stocks with a high average daily volume since these stocks will usually have a narrower Bid/Ask Spread than stocks with a lower average daily volume. Stocks that don’t meet this requirement can be eliminated from consideration. For example, my rule is never to consider a stock that averages under 1 million shares per day.

- Focus on stocks that also have options available, even if you don’t trade options. The most popular stocks will typically be optionable, making for a more advantageous Bid/Ask Spread. Also, optionable stocks have more flexibility by adding safety and enhancing returns if option strategies are implemented. You may never use options, but it is nice to know you have this choice if you change your mind.

- If possible, watch the stocks you are interested in while the markets are open. Along with following price action, you can also follow the Bid/Ask Spread movement. How far apart is the spread? Does the spread distance usually stay the same or fluctuate during the day? If the Ask Price goes up, does the Bid Price go up by the same amount, and vice versa? Over the years, I have taken some heat for constantly watching the markets during the day. It has been assumed that I am looking at prices. I am not. What I am really watching is the behavior of the Bid/Ask Prices and the Spread. There is one caveat. Bid/Ask Prices that are displayed after the market closes can be misleading. What you see on your screen may be skewed and not be a good source for evaluation. However, many stocks trade around the clock, allowing for observation even when the US markets are closed.

Bid/Ask Changes

Bid/Ask Prices change all of the time. This can happen multiple times each minute. Even if no actual trades occur, the Bid/Ask Prices constantly change to entice trading action. It’s a bit like a store owner hanging a sign out front promoting a price for a product. If customers come in and buy after seeing the sign, theoretically, another sign with a higher price may be displayed. Inversely, if no customers come in to buy, another sign may be displayed showing an even lower price. The store owner may keep doing this until there are sales or gives up and goes home.

Example of the Bid/Ask Spread for Two Stocks

Stock A has a Bid/Ask Spread of five cents ($0.05). That means a buyer will pay $10.05 per share, and sellers will receive $10 per share.

Stock B has a spread of one cent ($0.01). That means a buyer will pay $10.01 per share, and sellers will receive $10 per share.

In this case, with all things being equal, Stock B is the more attractive stock.

Long-Term Investors

If you are a long-term investor (investments lasting months to years), you may not be very concerned with the Bid/Ask Spread. Since you plan on holding on to a stock for many years or even decades, this may not be very relevant in your initial decision-making process. However, over time, stocks gain and lose popularity. Stocks that were highfliers at one time might fall out of favor, and vice versa. So, even long-term investors should keep an eye on the average daily volume and the Bid/Ask Price behavior. This becomes even more imperative if you are preparing to sell any shares or buy more shares.

Short and Intermediate-Term Traders

If you are a short-term (days to weeks) or an intermediate-term (weeks to months) trader, the Bid/Ask Spread can be very critical. You might not be okay with a 0.05 Bid/Ask Spread since it causes too much slippage. In that case, the 0.01 is more attractive.

What Makes the Bid/Ask Prices Move?

To help understand why prices move, it is necessary to understand supply and demand. Supply is when there are more sellers than buyers. Demand is when there are more buyers than sellers.

Here is an oversimplified example:

For a stock, let’s say there are two lines. One line is for buyers, and another line is for sellers. The market maker sees the length of each line. If the “buy line” is long, the market maker will likely raise the Ask Price. If the line remains long, the market maker may try to keep raising the Ask Price until the buy line has disappeared or has at least grown smaller. As long as there are buyers in line, the price can be increased. If the “sell line” begins to grow, the market maker will lower the Bid Price until sellers are no longer interested in selling at lower prices. Remember that you and the market maker want opposite things. The market maker wants to sell to you at the highest possible price, while you want to buy at the lowest possible price. When selling, you want to sell at the highest possible price, while the market maker wants to buy from you at the lowest possible price.

When a stock declines quickly or even crashes, that is because there are more sellers than buyers. The same is true as prices skyrocket higher. That is because there are more buyers than sellers. The forces of supply and demand can get pretty lopsided at times. There must be a buyer and a seller for each transaction, even if it’s the market maker.

When there is the same number of buyers and sellers, things are even. This is usually when prices move sideways. However, once there is an imbalance, this causes the stock price to move up if there are more buyers or to move down if there are more sellers.

The Holy Grail?

If you wanted a holy grail to the stock market, this is it. This may not be complicated, but it doesn’t mean it’s easy. There’s not a lot of other things going on. It can get a bit more complex, and you need experience to know how to work these things the right way. There are buyers and sellers who come together in a stock exchange, which might be a physical place, or it might be over a computer. One side agrees to buy, while the other agrees to sell.

Conclusion

Understanding the Bid/Ask Price and the Bid/Ask Spread can help you make better decisions using information that many investors ignore or don’t consider necessary. As with any skill, this can take time and dedication to develop.